After a decade of providing tax services to thousands of service members and other qualified clients, nothing is more gratifying than sharing tax pointers to help clients maximize the tax law to advance their financial position. Below are not just tips, but true stories from my eventful years of providing this annual service:

Rental Income: Although often a headache for most landlords, there are several tips that will reduce tax concerns at the end of the year. First, all rental expenses should be on one dedicated credit card. This single type of tracking method allows the landlord to simply print an end of the year statement that will track all expenses dedicated to the rental income, including airfare, car rental, lodging, meals, supplies, services and improvements, to name a few.

Second, property managers are generally worth the average 10 percent of rental income because they act as a local representative who is immediately available to handle tenant issues, especially when it involves emergencies that may occur at all hours of the day. In addition, management service is a direct deduction from the rental income generated.

Third, if you want to get into the rental business, choose a state that you would want to visit frequently because the tax law allows you to deduct two trips a year to visit your rental property. Landlords should know that it’s not just your airfare that is deductible, but also the lodging, car rental, and a percentage of meals. Most landlords view this process as a paid vacation, compliments of the tax code.

Savings Account: Federal service, military or civilian, affords the individual the best method to shelter income through the Thrift Savings Plan. A great example of this TSP savings involved a service member who recently received service at our tax center. This soldier had $6,000 withheld from his taxes and received a few dollars above his withholding after filing his return.

We simulated the tax return and instead placed the $6,000 withheld into TSP, which would have resulted in a return of $1,800 and a savings account that generated substantial earnings. Essentially, this soldier ‘s return on investment would have exceeded $2,400 for placing his $6,000 into the TSP. Remember, TSP could always be borrowed without increasing your tax rate or withdrawn for first-time home purchases with no penalty.

Magic Date: If you plan to get married or start a family, 31 December is the date to commit to this life-long commitment. As most of you know, the annual standard deduction for married filing jointly is $12,700, whether you are married all 365 days or just one day. On the other hand, if you are experiencing marriage difficulty, it’s better to solidify a divorce than to file Married Filing Separately, (MFS). Most clients should avoid filing MFS because this status cancels major filing benefits such as tuition deduction, child tax credit, earned income credit and education credit, to name a few. Lastly, if you plan to grow your family, child tax credit and earned income credit are advantageous regardless if you have the child for one day or 365 days of the year.

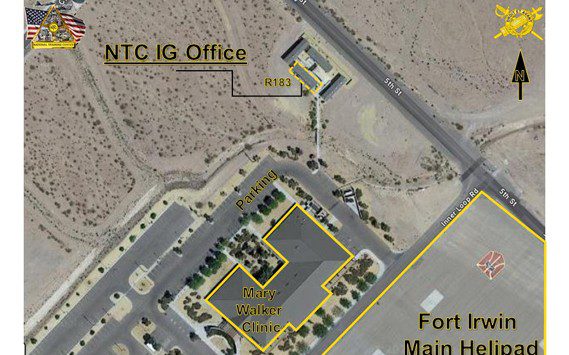

For more information regarding the above tax tips, please feel free to contact our Fort Irwin Tax Center at (760) 380-1040, or your legal assistance office at (760) 380-5321.